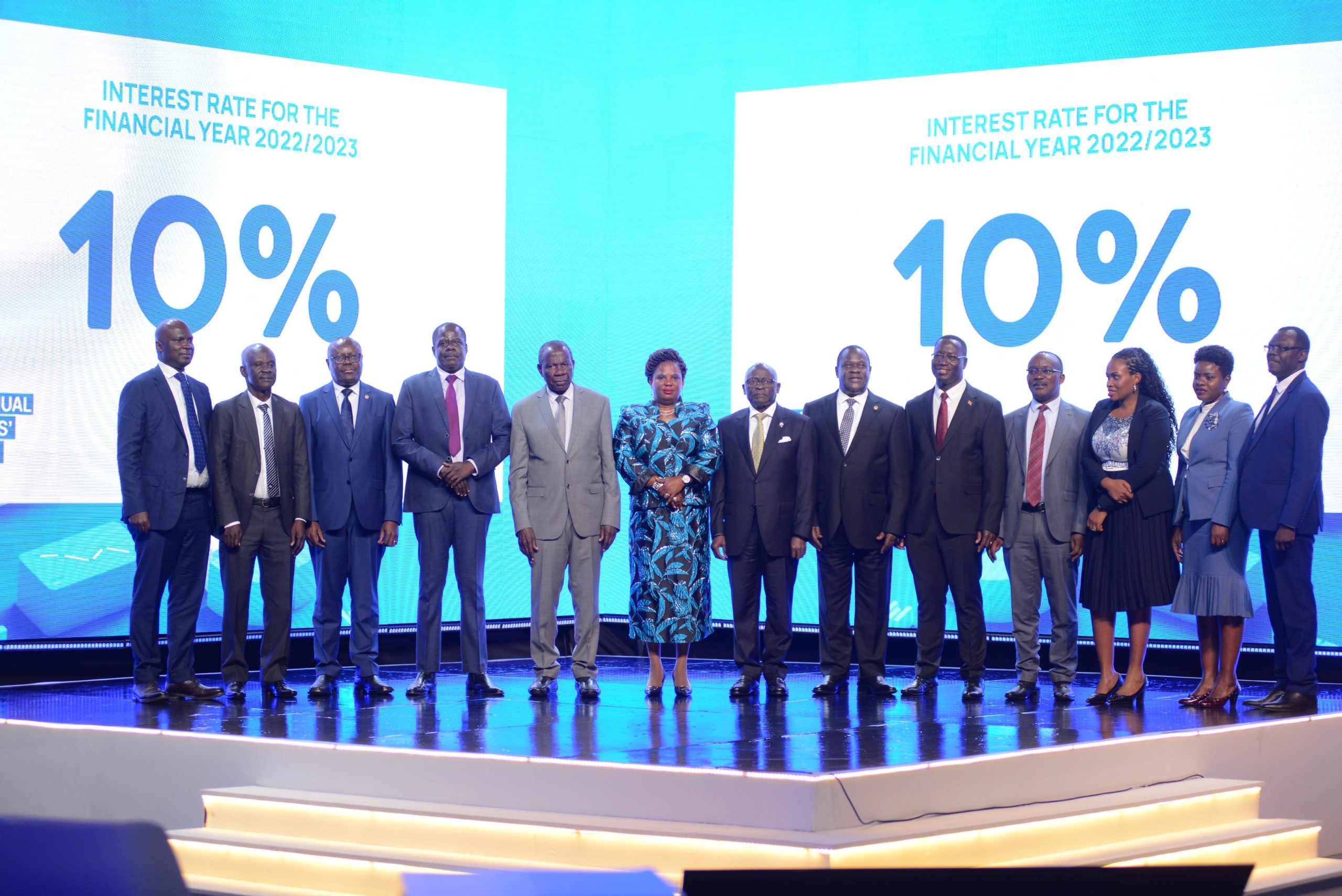

The National Social Security Fund (NSSF) will pay its members a 10% interest on their savings for the 2022/23 financial year, according to Finance Minister Matia Kasaija. This is higher than the 9.35% interest paid last year, which was the lowest rate in the past decade.

Experts had predicted a return to double-digit interest rates this year, with expectations ranging from 10% to 14%.

NSSF’s managing director, Patrick Ayota, attributed the growth in earnings to interest income, which climbed from sh1.79 trillion to sh2 trillion, and dividend income, which grew from sh84b to sh139b.

In a statement, Ayota said that the Fund was “thrilled” to be able to pay its members a higher interest rate this year. He said that this was a result of the Fund’s sound investment strategy and its focus on delivering value to its members.

“We are committed to continuing to invest wisely and prudently to ensure that our members receive competitive returns on their savings,” Ayota said.

The NSSF is a mandatory social security scheme for all employed Ugandans. It provides retirement, invalidity, survivor’s, and emigration benefits to its members.

The Fund’s assets have grown significantly in recent years, reaching sh17.8 trillion at the end of June 2023. This makes the NSSF one of the largest institutional investors in Uganda.