(Kampala) – Cryptocurrency, a digital form of money, has gained significant attention since its inception, yet many still find it challenging to understand its purpose and workings.

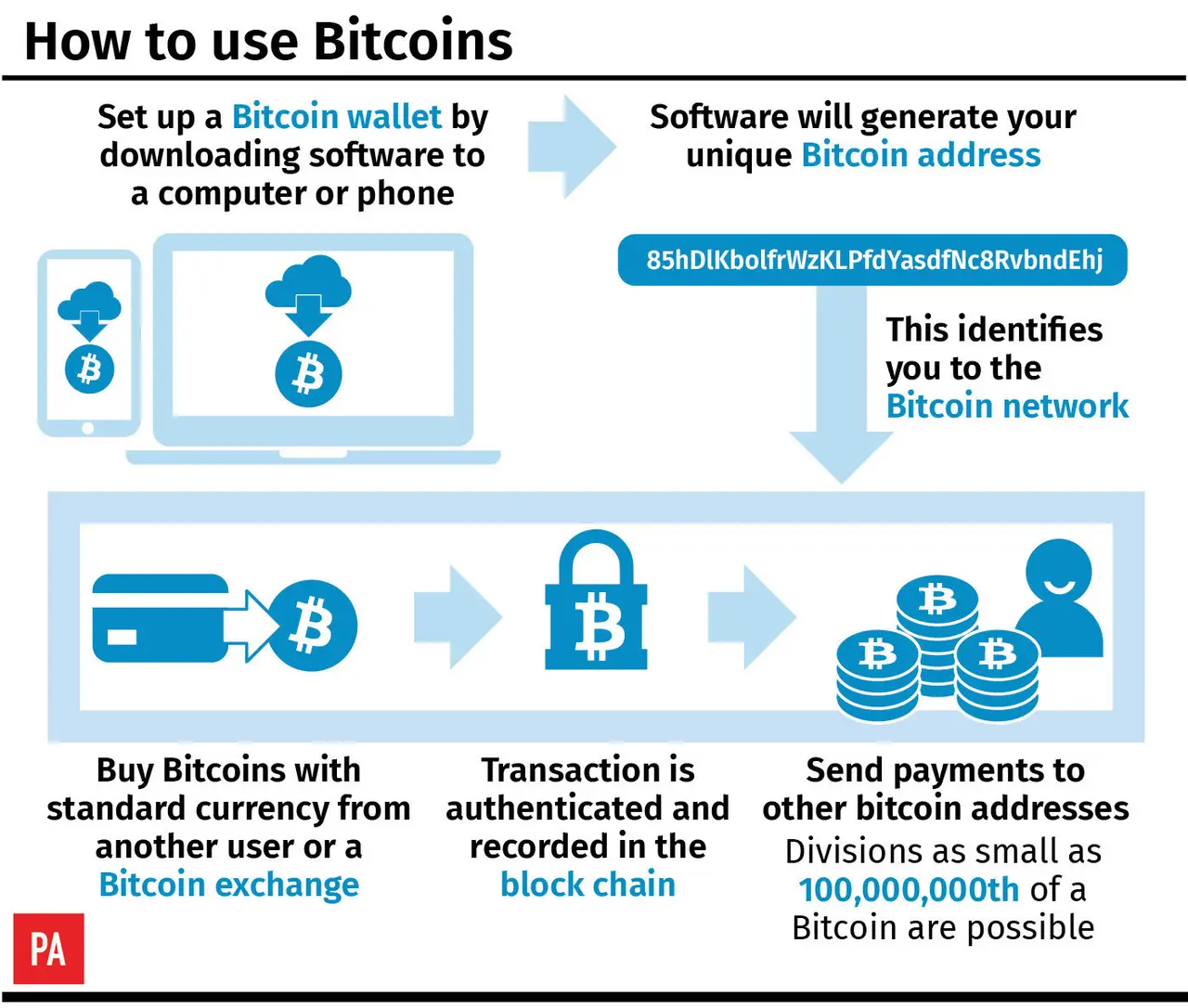

Cryptocurrency refers to a type of digital currency that exists only in the online space, without any physical form like traditional currencies such as dollars or pounds. The most notable cryptocurrency is Bitcoin, created in 2008. Essentially, a Bitcoin is a digital file stored in a software application known as a digital wallet. Users can send and receive cryptocurrencies easily, and these assets are often exchanged for traditional money.

Bitcoin operates on a decentralized system, meaning it is not regulated or stored by any single entity, such as a government or financial institution. Instead, all transactions are recorded on a technology called blockchain. This system resembles an online spreadsheet shared among users worldwide, ensuring that no one person can alter the records. Participants in the network receive small financial incentives for maintaining the accuracy of the ledger, which is designed to be unchangeable. This independence from traditional financial systems attracts those who wish to distance themselves from the control of banks and governments.

Despite its growing popularity, using cryptocurrency for everyday purchases remains a challenge, especially in places like the UK. Although some businesses accept cryptocurrency, many do not. The appeal of crypto lies in its ability to facilitate transactions outside traditional banking channels, making it particularly attractive for individuals who frequently send money across borders, where conventional systems often charge high fees. Additionally, the relative anonymity provided by many crypto platforms can be appealing since they typically require fewer identity checks than banks.

However, this anonymity poses risks, as criminal organizations and individuals have exploited cryptocurrencies for illicit activities, including money laundering and illegal transactions with sanctioned countries.

One of the primary attractions of cryptocurrency is its volatility. For instance, the price of a single Bitcoin reached approximately £27,000 in October 2023, nearly doubling in value from the previous year. Those who invested in Bitcoin years ago, when its price was around £260, may find themselves reaping significant financial rewards. This potential for quick profits contrasts sharply with traditional investments, such as stocks and shares, which tend to exhibit more stability.

Despite the allure of high returns, investing in cryptocurrencies is fraught with risks. The market has experienced severe fluctuations, with notable crashes occurring in 2018 and 2022, leaving many investors devastated. High-profile failures, such as the collapse of the FTX exchange in 2022, have highlighted the dangers involved in crypto trading. The founder of FTX, Sam Bankman-Fried, was later sentenced to 25 years in prison for defrauding investors out of billions of dollars.

While Bitcoin’s current price approaches record highs, it remains a speculative investment. Experts advise potential investors to approach cryptocurrencies with caution and emphasize the importance of only investing what one can afford to lose.

| Aspect | Details |

|---|---|

| Type | Digital currency (Cryptocurrency) |

| Notable Example | Bitcoin |

| Creation Year | 2008 |

| Transaction Model | Decentralized via blockchain |

| Risks | High volatility, potential for scams |

| Regulation | Generally unregulated |