(Kampala) – Uganda’s Parliament has approved the absorption of three government agencies into the Ministry of Finance, Planning, and Economic Development as part of the government’s rationalisation efforts to streamline operations and reduce duplication of roles.

The three agencies—the Uganda Microfinance Regulatory Authority (UMRA), the Privatisation Unit, and the Non-Performing Assets Recovery Trust—will now be managed directly by the Ministry of Finance. The rationalisation of these agencies was discussed and approved during a parliamentary session on November 6, 2024.

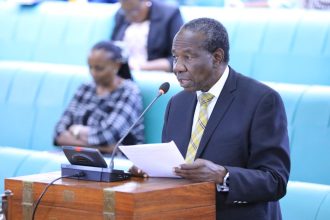

In his report on the Tier 4 Microfinance Institutions and Money Lenders (Amendment) Bill, 2024, Finance Committee Chairperson Hon. Amos Kankunda highlighted that UMRA had faced challenges in fully executing its mandate. Although the authority licensed several money lenders and microfinance institutions, it lacked sufficient resources throughout its eight years of operation. Kankunda pointed out that new financial services, such as Parish Development Model SACCOS, now require enhanced regulation, which UMRA was unable to provide effectively.

Hon. Nathan Nandala-Mafabi (FDC, Budadiri County West) revived a 2016 proposal to place the management of Tier 4 institutions, including SACCOS, under the Bank of Uganda. Nandala-Mafabi argued that since the Bank of Uganda oversees financial services, it should also handle these smaller financial institutions. However, Hon. Paul Omara (Otuke County) countered that the Bank of Uganda would need a new department to manage Tier 4 institutions, and that any move to transfer the responsibility would require engagement with the bank to establish the necessary structure.

The Attorney General, Hon. Kiryowa Kiwanuka, advised that the proposal be further studied, while Parliament focused on the broader rationalisation process. As part of the restructuring, the Ministry of Public Service announced the creation of a new Microfinance Tier 4 Management Department within the Ministry of Finance to take over UMRA’s functions.

In addition to the UMRA adjustments, Parliament also considered the dissolution of the Privatisation Unit. The Public Enterprises Reform and Divestiture (Amendment) Bill, 2024, will transfer the functions of the Divestiture Reform Implementation Committee to the Ministry of Finance, aiming to eliminate overlapping roles and reduce operational costs.

Following the passage of the Non-Performing Assets Recovery Trust Act (Repeal) Bill, 2024, the Finance Committee recommended a special audit of the Trust, which has been operational since its inception. Hon. Moses Aleper, Deputy Chairperson of the Finance Committee, also called for the immediate dissolution of the Non-Performing Assets Recovery Trust Tribunal. All pending cases, if any, will be transferred to the Office of the Attorney General to further streamline operations and reduce administrative costs, in line with the government’s rationalisation policy.