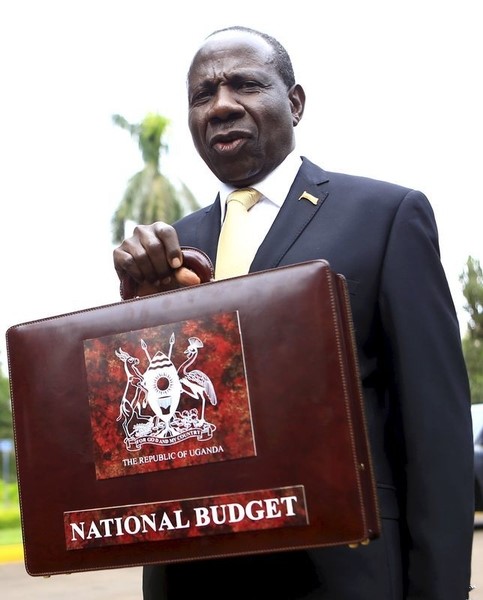

In a report released by the Ministry of Finance on Monday, it was revealed that a decline in manufacturing and a reduction in spirits sales negatively affected tax collections in September. The report indicates that both excise duty and value added tax fell below their respective targets, resulting in a shortfall of UGX 26.83 billion in domestic tax collections.

The slowdown in manufacturing had a significant impact on excise duty, which was affected by lower-than-anticipated sales of spirits. Additionally, the reduction in sales of spirits led to a decline in revenue from value added tax. This overall decline in tax collections had consequences for the government’s fiscal position.

Under the category of direct domestic tax, pay as you earn (PAYE) registered a surplus. However, there were shortfalls in corporate, casino, and treasury instruments taxes. The Ministry of Finance reported that indirect domestic tax collections, managed by the Uganda Revenue Authority (URA), were below target, with URA realizing UGX 549.2 billion, falling short of the targeted UGX 576 billion.

Furthermore, shortfalls were recorded in taxes on international trade, which were UGX 90.36 billion below the target of UGX 856.75 billion. Value added tax, withholding tax, and import duty, all related to imports, also underperformed, contributing to the revenue deficit.

As a result of these shortfalls, domestic revenue collections fell below the projected UGX 2.187 trillion, with URA realizing UGX 2.03 trillion in total, comprising UGX 1.8 trillion in tax revenue and the remainder in non-tax revenue. The overall tax collection remained UGX 158.89 billion below the target, with shortfalls in direct, indirect, and international trade taxes contributing to the deficit.

The report also highlighted government expenditure during the period, indicating that total government expenditure stood at Shs2.3 trillion, which was lower than the planned Shs2.6 trillion. This was partly due to underperformance in development projects, with disbursements from development partners falling short of the planned target. Additionally, recurrent item expenditure was 4.3 percent below target, mainly because some ministries, departments, and agencies had front-loaded their expenses during the first two months of quarter one.

Consequently, the government operations in September resulted in a fiscal deficit of UGX 231.8 billion, exceeding the planned deficit of UGX 216.8 billion. The fiscal deficit was attributed to shortfalls in both domestic revenues and grants during the month.