Women in small and retail businesses have been advised to embrace digital marketing tools and networking as ways of promoting their products and business.

Speaking at the Equity Bank’s Abakyala Ku Ntiiko women initiative held at Lira Hotel in Lira City, Prof. Judith Abal, who was the keynote speaker, challenged women to master social media platforms as marketing platforms instead of using them as gossip platforms.

“The youth you see here are beating you in selling their products because they have adopted the new technology platforms as marketing tools. Do not fear, ask them to teach you,” said Prof. Judith Abal.

The Abakyala Ku Ntiiko initiative aims to support women in micro and retail businesses by helping them gain financial knowledge, business skills, and access to financing from the bank.

Statistics show that over 38 percent of women engaged in business struggle to access banking services, mainly loans and insurance products, making it hard to expand their businesses. Abakyala Ku Ntiiko is changing this by offering financial education, peer mentorship, affordable loans, and insurance products specifically designed for women.

“Don’t run only one business! Endeavor to operate at least two or more small-scale businesses to cater to seasonal demand changes if you want to pay back your Equity loan conveniently.” She also emphasized the importance of quality, saying, “The reason why most businesses are collapsing is basically due to poor-quality services and poor-quality products,” said Prof. Judith Abal, Head of the Department of Commerce and Business Management at Lira University.

Peter Ssemakalu, Equity Bank’s Regional Manager for Greater North, appreciated the women for turning up in large numbers and advised them to embrace bank products such as EquiMama and the newly introduced insurance products that will provide hospital cash for women and others in the micro sector.

“To every woman here today, thank you for choosing Equity Bank as your financial partner. Your trust in us is not taken for granted, and your invaluable contributions to Uganda’s economic growth are truly commendable.”

“We are fully dedicated to empowering women in Lira and beyond, not just with financial solutions, but with the tools and knowledge to transform lives. Let us join hands as partners in this mission. Together, we can and will chase poverty out of our homes and communities,” he said.

Tony Obonyo, Equity Bank’s Micro Supervisor, highlighted some of the key financial solutions tailored for women, including the Equi-Mama Loan Product, SAACO loans, which encourage collective savings, and community wealth-building. He also mentioned the Equi-Green Financing that supports environmentally friendly business initiatives with special financing terms.

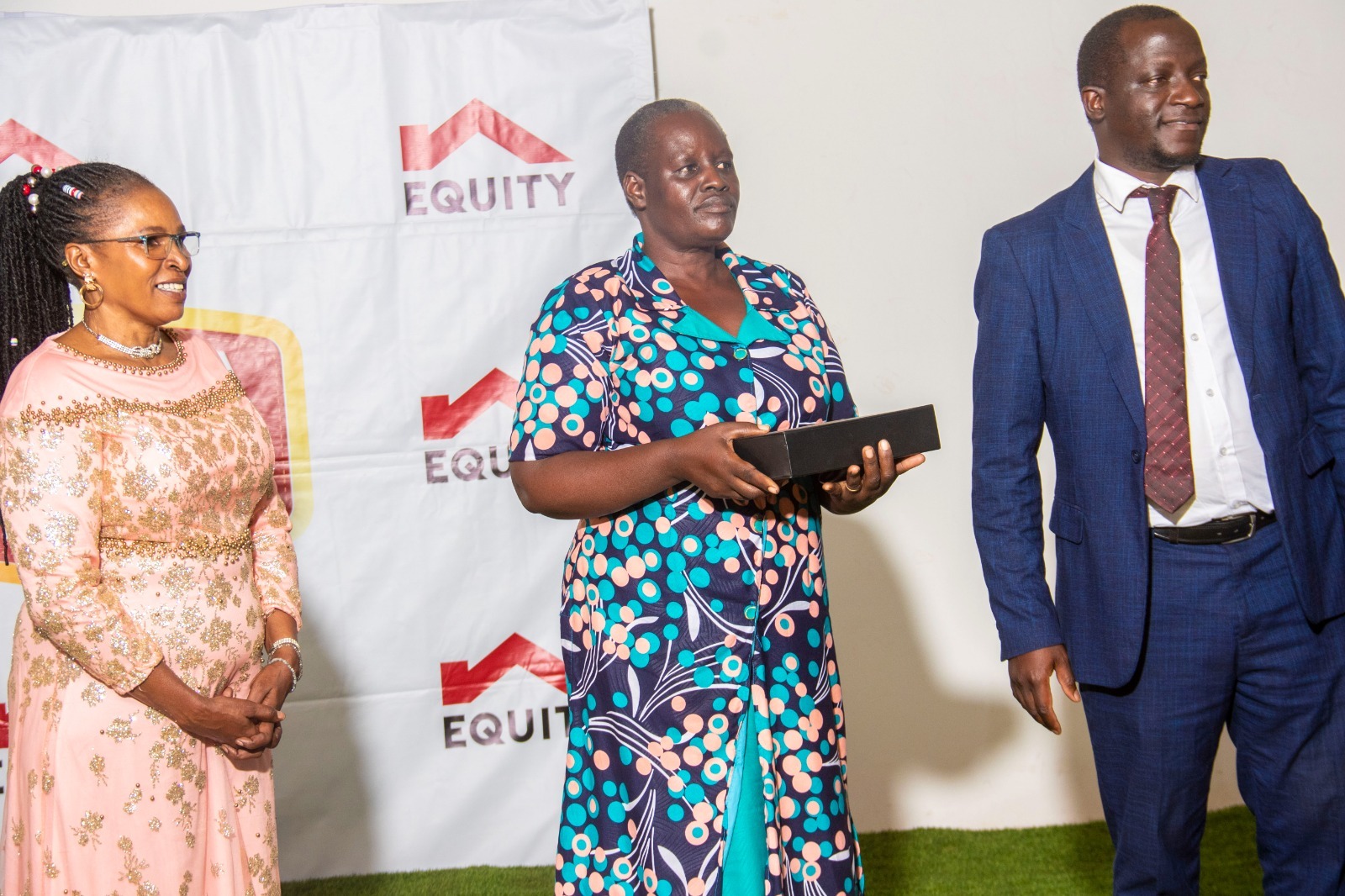

The event also recognized top customer achievers: Caroline Adong as the best mobilizer for the bank, Juliet Obedo as Top Saver, and Eunice Abeja as the most compliant customer.

Looking ahead, Equity Bank plans to offer more peer mentorship, affordable loans and insurance products, financial education, and work with local partners to provide additional business support.