EBO SACCO has strengthened its efforts to widen access to financial services after forming a strategic partnership with Equity Bank, a move aimed at supporting underserved communities across the country.

The partnership, which operates under a linkage banking arrangement, allows EBO SACCO members to access a wider range of banking services through Equity Bank’s infrastructure, including larger loan facilities, secure accounts, and digital financial solutions.

Speaking about the collaboration, EBO SACCO Chief Executive Officer Joseph Mugume said the partnership was built on a shared goal of empowering ordinary people.

“We have always believed that financial growth should start with the people,” Mugume said. “Working with Equity Bank gives our members opportunities that were previously out of reach, while still maintaining our cooperative values.”

Founded in 2000 in Bwizibwera Town Board along the Mbarara–Ibanda road, EBO SACCO began as a small community initiative and has since grown into a regional institution with branches across more than 35 districts. The SACCO mainly serves smallholder farmers, traders, and other groups often excluded from traditional banking systems.

Through the partnership, EBO members are now able to benefit from improved digital services, safer transactions, and access to capital that supports agriculture, small businesses, and household development.

Mugume noted that many members rely on agriculture and informal trade for income, and EBO’s products are designed to match those realities.

“Our people depend on farming and small enterprises,” he said. “Our role is to support activities that directly improve their livelihoods.”

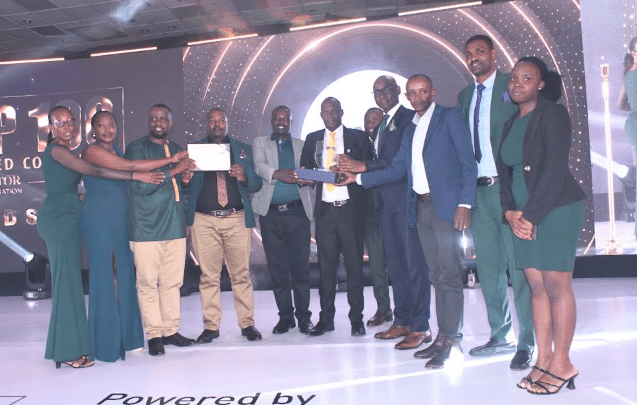

Equity Bank’s support has also helped EBO SACCO strengthen its governance and compliance standards, enhancing member confidence and safeguarding savings. The collaboration recently earned EBO SACCO national recognition after it received the 2025 Equity Bank Pinnacle Award.

Mugume said the award reflects years of discipline, trust, and commitment to transparency.

“This recognition confirms that when you manage people’s money with integrity, growth will follow,” he said.

With plans underway to expand operations into more regions, EBO SACCO says the partnership with Equity Bank will remain central to its mission of breaking financial barriers and promoting inclusive economic growth.