Hoima, Uganda – Equity Bank Uganda has officially concluded its nationwide “Tupange Business Ne Equity” campaign with a final engagement in Hoima. The campaign was designed to support small and medium enterprises (SMEs) by providing access to financial guidance, networking opportunities, and practical business knowledge.

The journey began in Kampala and proceeded to Mbale, Arua, and Fort Portal before culminating in Hoima. At each stop, the campaign brought together entrepreneurs, traders, and community leaders to exchange experiences and explore solutions to common business challenges.

The Hoima event gathered a wide range of business owners, local leaders, and stakeholders—all focused on strengthening the local business ecosystem and promoting inclusive economic growth. Participants discussed practical ways to improve access to finance, manage competition, and run businesses more efficiently.

Speaking at the event, Olivia Mugaba, Head of SMEs at Equity Bank Uganda, emphasized the critical role SMEs play in Uganda’s economy. She noted that SMEs contribute nearly half of the country’s income and create seven out of every ten jobs. “You are the people who keep the world moving,” she told attendees. However, she also warned that 50% of SMEs fail within their first three years, not due to lack of potential, but because of barriers such as limited financing, inadequate skills, and weak links within the value chain.

Mugaba stressed that financing SMEs goes beyond loans—it requires strengthening every part of the value chain, from farmers and suppliers to manufacturers and retailers. She also shared a success story of a client who began as a micro-SME with a UGX 20 million loan, and has since grown into a multi-billion-shilling enterprise. “Our greatest pride comes from seeing SMEs grow from micro ventures into multi-corporations,” she said.

Clare Tumwesigye, Head of Marketing and Communications at Equity Bank, speaking on behalf of the Managing Director, Mr. Gift Shoko, reaffirmed the bank’s commitment to all types of clients—from individuals to large corporates. “No financing is too big for us. Whether you’re just starting, scaling up, or fully established, we have solutions to walk with you at every stage of your journey,” Tumwesigye stated.

Reflecting on the impact of COVID-19, she highlighted Equity Bank’s launch of the $6 billion Africa Recovery and Resilience Plan aimed at empowering key sectors such as agriculture, tourism, manufacturing, and MSMEs. “When SMEs recover, Africa recovers,” she noted.

Tumwesigye encouraged SMEs to adopt an “ecosystem mindset.” “Every supplier, transporter, and partner is part of your value chain. If one link breaks, the whole chain is affected. That’s why Equity supports the entire ecosystem, from the smallest supplier to the largest anchor—to ensure no business is left behind.”

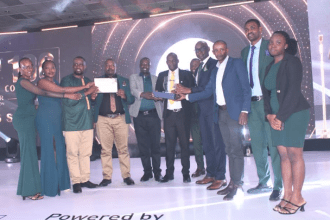

The event also celebrated outstanding SME clients, awarding: Mr. John Magara, owner of Hoima Buffalo Hotel and Business Hub Ltd – SME Business Influencer Award; Mr. Amator Nyendwoha, Director of St. Peter’s High School – SME Customer Loyalty Award; and Aloysius Ntale of Ntale and Sons Kiboga Depot (beverage distributor) – Best Ecosystem Customer Award.

Mr. Amator Nyendwoha recounted his journey with Equity Bank, which began in 2013 after being turned away by other banks. A committed Equity staff member helped him open an account, manage financial records, and eventually access a UGX 15 million loan to expand his school. Later, he secured an unsecured UGX 200 million loan within just two weeks, which helped diversify his ventures into farming. “Equity Bank treated me like a priority, even when others ignored me,” he said. “This is the bank I can trust. Equity doesn’t just do transactions it guides, advises, and funds growth.”

Mr. John Magara reflected on his early financial struggles, including taking loans and losing his family home. Through his partnership with Equity Bank, he recovered and transitioned from rice milling to alcohol distillation, and eventually into the tourism sector. Recalling the COVID-19 pandemic, Magara said many businesses thought survival was impossible, but with Equity Bank’s support, his operations remained afloat, preserving over 170 jobs. “SMEs go through cycles of setbacks and recovery. Support systems like Equity Bank’s value chain financing are crucial. When one link breaks, the entire chain is affected,” he said.

The Hoima event marked the final stop of the “Tupange Business Ne Equity” campaign across Uganda. More than a financing initiative, the campaign offered entrepreneurs a platform for learning, mentorship, collaboration, and innovation. By focusing on resilience, value addition, and ecosystem development, Equity Bank continues to empower Uganda’s entrepreneurs to thrive.