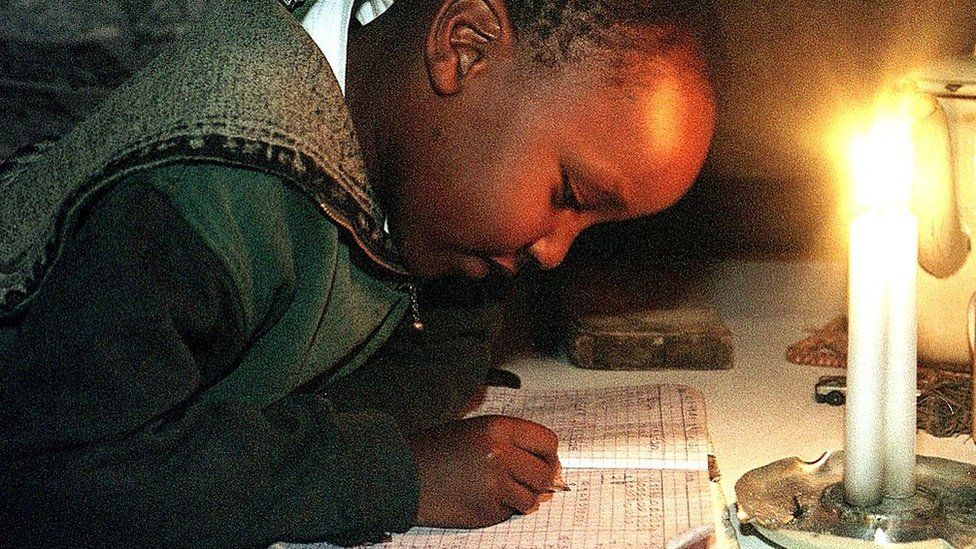

A debt spiral is engulfing Africa, hindering crucial investments in infrastructure, health systems, and education. Multiple countries have resorted to taking new loans to repay existing debts, exacerbating the continent’s worst-ever crisis. Sub-Saharan Africa, where defaults are prevalent, grapples with the repercussions, casting a shadow over global economic growth.

In the aftermath of the 2007-2009 global economic crisis, central banks in developed nations maintained low-interest rates. This facilitated unprecedented access to financial markets for Global South countries, often urged by the International Monetary Fund. The rush for low-cost loans in unregulated markets provided a boost to African economies. However, the fall in commodity prices since 2015, exacerbated by the Covid pandemic, squeezed foreign currency revenues, triggering a precarious situation.

Last year, the World Bank identified 22 countries, including Ghana and Zambia, at a heightened risk of over-indebtedness. Malawi and Chad also faced challenges, with Ethiopia negotiating a rescue package after being placed on partial default by Fitch Ratings in December.

Table 1: Countries at Heightened Risk of Over-Indebtedness

| Country | Risk Level |

|---|---|

| Ghana | High |

| Zambia | High |

| Malawi | Moderate |

| Chad | Moderate (IMF) |

| Ethiopia | Partial Default (Fitch) |

African public debt surged to $1.8 trillion in 2022, a 183 percent increase from 2010. While Western public creditors, G20 partners, and China aimed for debt restructuring, private lenders, holding 42 percent of African foreign public debt, posed challenges. China, often criticized, engaged in efforts, recognizing the need to aid struggling nations.

Table 2: Composition of African Foreign Public Debt in 2022

| Lender | Percentage |

|---|---|

| Private Investors | 42% |

| Multilateral Institutions | 38% (IMF and World Bank) |

| Other Nations | 20% (China: 11%) |

Private lenders, including investment funds, hindered debt deals, complicating negotiations. Notably, BlackRock, a major holder of Zambian debt, blocked the “historic” debt restructuring deal, illustrating the challenges faced by African nations.

Higher interest rates intensify the burden, causing dangerous currency fluctuations and escalating inflation. Charles Abugre, a Ghanaian economist, emphasizes the severe impact on the daily lives of the poor, with rising costs of transport, food, and housing, coupled with stagnant real wages.

In addressing the crisis, Amine Idriss Adoum from the African Union Development Agency stresses the importance of intelligent borrowing. While debt restructuring is crucial, it should not undermine investments in infrastructure, health, and energy vital for supporting economic and societal development.