The Kenyan National Treasury has gone back to using Gross Domestic Product (GDP) to determine the country’s debt ceiling.

Previously, Kenya had employed this method, but in 2019, it shifted to a fixed numerical debt ceiling, even as the country’s debt surpassed Ksh10 trillion in June 2023.

Under a new law signed by President William Ruto, the debt ceiling will now be set at 55 percent of GDP.

Members of Parliament (MPs) highlighted that this approach enhances the transparency of debt measurement, as it relates public debt to the country’s income and its capacity to repay.

By the close of 2023, Kenya’s GDP is expected to reach Ksh17.7 trillion, which means that by current estimates, the country has already exceeded the 55 percent limit. Under the new law, Kenya’s debt would be limited to Ksh9.6 trillion. However, because of the prior numerical debt ceiling method, the country’s debt has exceeded this limit by Ksh500 billion.

In contrast, the government anticipates adhering to the 55 percent target by 2027, providing a five-year grace period for President William Ruto’s administration to establish policies and frameworks to control the growing public debt.

Additionally, in the event of extreme or exceptional economic circumstances, the government will be allowed to borrow up to 60 percent of GDP. The new law defines extreme and exceptional circumstances as natural disasters or certain political events.

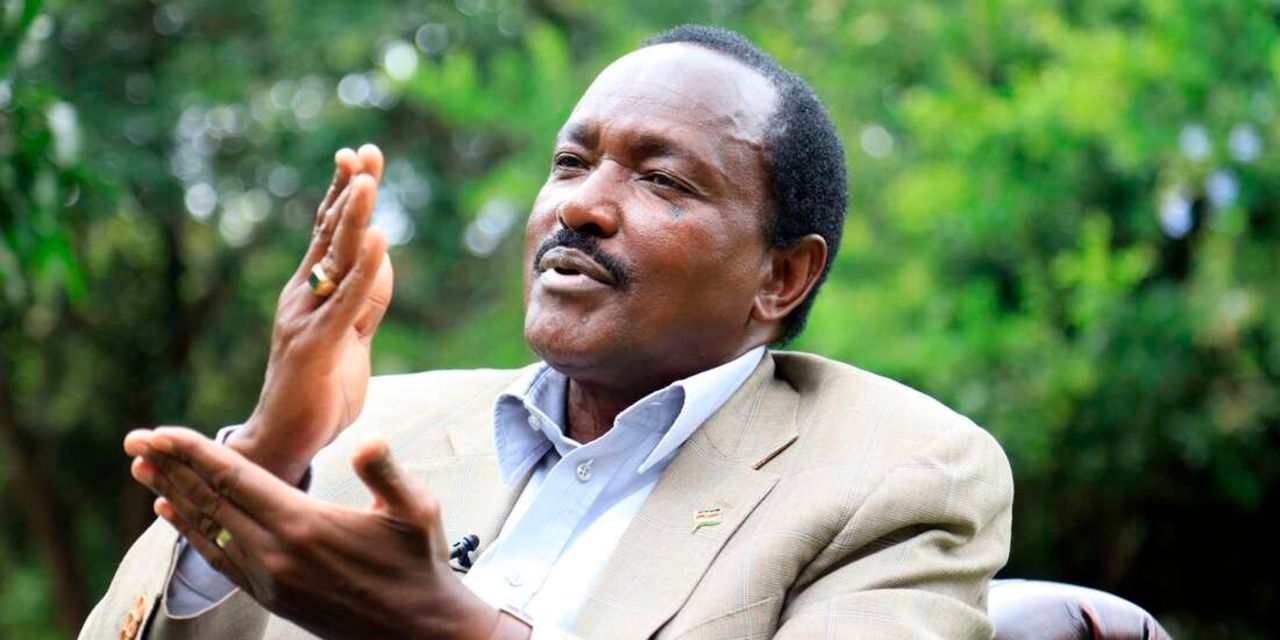

Last week, during an interview with NBC News, Central Bank Governor Kamau Thugge explained that the debt exceeded Ksh10 trillion due to the impact of the COVID-19 pandemic and the conflict in Ukraine. Governor Thugge also pointed out that an unprecedented drought in Kenya led to a contraction in the agricultural sector, forcing the government to borrow more to sustain the economy.

Governor Thugge assured the international community that Ruto’s administration had implemented measures to help Kenya recover from global and internal economic shocks. He projected that the country’s economy was poised to grow by 5 percent, which is higher than the global average and 2 points higher than the projections for economies in Sub-Saharan Africa.