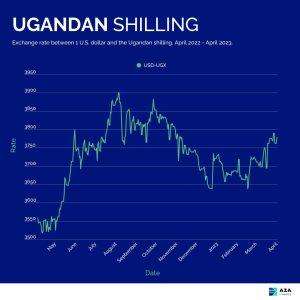

The Uganda Shilling has experienced a rollercoaster ride, marked by volatility, yet the Bank of Uganda sheds light on its resilience by reporting a 0.9 percent depreciation in 2023, a slight improvement from the 1.6 percent recorded in the previous year, 2022.

In 2022, the effective exchange rate reflected a year-on-year depreciation of 1.6 percent, signifying the weakening of the Uganda Shilling against the weighted basket of currencies from the country’s trading partners. Despite these challenges, the central bank asserts that the Uganda Shilling has maintained relative stability against the US dollar, even in the face of depreciation pressures in the quarter leading up to November 2023.

Responding to inquiries from the media regarding the Shilling’s performance in 2023, Dr. Adam Mugume, the Executive Director of Research at the Bank of Uganda, stated that the Shilling remained stable in the initial eight to nine months of the year, fluctuating within the range of Shs3,694-3,746 per dollar. However, he acknowledged the emergence of noticeable depreciation pressures in the last quarter of 2023.

Dr. Mugume attributed this late-year depreciation to various factors, including the World Bank’s decision to freeze new project financing in Uganda following the implementation of the Anti-Homosexuality Act of 2023. The negative ratings assigned to Uganda by multiple rating agencies also contributed to sentiments that triggered a defensive purchasing of dollars, particularly in the absence of robust forward or hedging forex markets.

Comparing Uganda to its regional counterparts, Dr. Mugume highlighted that the Uganda Shilling’s depreciation of 0.9 percent in 2023 paled in comparison to the Kenyan Shilling (17.5 percent depreciation), South African Rand (12.6 percent depreciation), Tanzanian Shilling (3 percent depreciation), and the Rwandese currency (11.7 percent depreciation). In contrast, the Euro and British Pound strengthened against the dollar, appreciating by 2.8 percent and 0.7 percent, respectively.

Delving into the contributing factors for the Shilling’s depreciation in the latter part of 2023, Dr. Mugume mentioned the decline in international reserves due to external debt servicing. This, coupled with the inability to purchase forex from the market, hindered the Bank of Uganda’s intervention on the sale side during sharp depreciation pressures, signaling potential interpretations in the market.

Dr. Mugume expressed optimism about the economy, noting its slow recovery from the impacts of Covid-19. He outlined projections for economic growth and benign inflation in 2024, laying a solid foundation for Foreign Direct Investment (FDI) inflows estimated at around $2.9 billion. With rising export receipts, workers’ remittances, recovering tourism receipts, and fiscal consolidation, the Bank of Uganda envisions a stable future for the Uganda Shilling.